Got Paid? Here’s Everything That’s Included in a Pay Stub!

Got paid recently? First of all, congratulations. Now that we’ve got that covered, here’s everything that’s included a pay stub!

Does your employer give you a pay stub when you get your check?

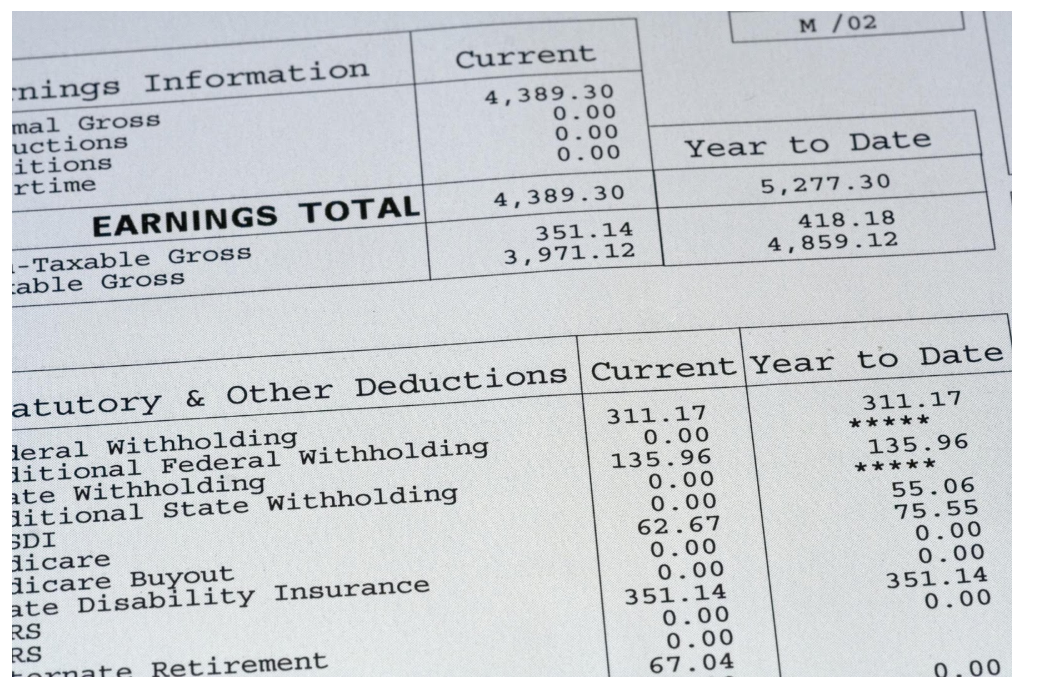

A pay stub tells you all you need to know about your weekly or bi-weekly earnings, like how much you make per hour, how many overtime hours you worked, and all of the deductions that were made.

It’s all vital information that you need in order to apply for loans and file taxes, but they can be difficult to understand sometimes.

Today, we’re going to teach you how to read a pay stub so that you’re never confused about how much money you have or what deductions have been taken off. The more you can learn about your pay stub, the better you’ll be able to keep track of your finances.

Vital Info

When you open up a pay stub, you’ll probably be a little bit overwhelmed by all of the information you see right off the bat. We’ll get to the pertinent info in a little it, but most pay stubs will have all of your (the employee) information at the top, alongside the employer’s information.

Employers that use a pay stub maker will have their choice of templates, so if this info isn’t at the top, it’s somewhere else on there. It’s vital to include these bits of information so you can easily tell who the pay stub was issued for, when it was issued, and whom it was issued by.

Here’s what you’ll see in this section:

- Your employer’s name and address

- Your name and address

- The pay period that the check is for (usually weekly or bi-weekly)

- The date of the payment

- Tax information – your SSN, employee ID, department number, etc.

Gross Pay

The payment section is likely the next thing you’ll look at underneath your vital information. Here’s where your hours worked and gross wages are displayed. It’s important to closely analyze this section to ensure that you’re being paid the right amount for how many hours you worked.

Some people keep track of the hours that they work during a given payment period so that they can make sure they aren’t being cheated out of any money. To calculate your gross pay, you just multiply the number of hours worked by your hourly wage. This is how much you earned prior to deductions.

If you’re a salaried employee this number should be the same on every pay stub.

In the event that you worked extra hours and are being paid an overtime wage for them, this will be displayed underneath your regular wage. Add that to your normal wage and you’ll have your total gross pay.

Deductions

Deductions encompass anything that is taken off of your gross pay in the pay period.

They’ll always include federal, state, and local tax deductions. They’ll also include a varying number of other deductions, including employee and employer contributions, which depends on what you’ve decided to pay into.

Tax Withholdings

Federal tax is what you owe to the IRS and your percentage will depend on your marital status and your income. The range is between 10% and 37%, with the high end being reserved for people making over $500,000 per year. You can check on the IRS website to figure out how much you should be paying.

Each state will have different income tax rates and a few states don’t have income tax at all. Most states that deduct income tax are, like the federal government, on a graduated system. Some states, like Pennsylvania, charge a flat rate (3.07%) across all income levels.

Your local area may or may not tax your income as well. This would usually fund things like community development and education.

Mandatory Deductions

The Federal Insurance Contributions Act (FICA) has your employer withholding some of your pay for social security and medicare. 6.2% of your pay is deducted for social security and 1.45% for Medicare, both of which your employee will match behind the scenes (this doesn’t show up on your pay stub).

The Medicare program pays for healthcare for American citizens over the age of 65, while social security tax pays for disability and retirement benefits that support millions of Americans.

Voluntary Deductions

There are also voluntary deductions that are removed before income tax is deducted. They might include health insurance, your flexible savings account, and retirement account contributions.

If your employer offers health insurance, then your contribution will be deducted off of each paycheck. A flexible savings account is something you’re allowed to pay into before tax to pay for things like medical services for yourself and your dependents and other qualified expenses.

When you’re saving through retirement with an employer-sponsored 401k plan, you’ll see this deducted from every paycheck. It’s important to make sure the amount is both correct on the pay stub and in your retirement fund.

Net Pay

You’ll see your net pay near the bottom of the pay stub. This is calculated by taking your gross pay and subtracting the tax withholdings, mandatory, and voluntary deductions. Your net pay is what goes into your bank account every pay period.

Most pay stubs will also display “year-to-date” information letting you know how much money you’ve earned for the year, how much you’ve paid in deductions and your take-home pay for the year.

All of this is important information for when you go to file taxes, so make sure that you keep all of your pay stubs filed away somewhere safe.

Reading a Pay Stub Isn’t So Hard

When you understand its different components, reading a pay stub isn’t that bad. Although it can be depressing to see how much you’ve earned versus how much you actually take home, it’s important to remember that you may one day benefit from FICA withholdings and you’ll definitely benefit from your retirement fund.

Always check your pay stubs to make sure everything looks in order. Human error happens sometimes, so bring any discrepancies forward to your boss as soon as you notice them.

Did you find this post helpful? Come back and visit us again for more on tech, finance, and the environment.

One thought on “Got Paid? Here’s Everything That’s Included in a Pay Stub!”