How To Get A Jump-start On Savings

Upromise® by Sallie Mae® is completely free to join, simple to use and a smart way to earn cash just by shopping online ,going out to eat, booking travel, and more. You can start saving for your child’s future… think college, student loans, auto loans, weddings and more!

If that doesn’t sound simple enough, than you are going to be blown away when you hear that Upromise also introduced the Upromise Mastercard to provide even more ways to earn cashback rewards with Upromise on everyday purchases. You can also earn up to 10% cash back for college, up to 5% when you make eligible purchases through Upromise.com, PLUS 5% when you pay for those purchases with the Upromise MasterCard.

Here are some additional ways to earn cash back with your Upromise MasterCard and other amazing benefits:

- 5% Cash back: Online shopping, online travel, restaurants

- 2% Cash back: Department stores, movie theaters

- 1% Cash back: On all other card purchases

- $25 Cash Back Bonus after first eligible use of the card within 90 days

- No limit to the total cash back you can earn on eligible purchases

- $0 fraud liability on unauthorized transactions

- No rotating reward categories

- A chip card makes paying for your purchases more secure at chip card terminals in the U.S. and abroad

- Complimentary FICO® Credit Score

I have spent so much time on the Upromise website, I am just blown away by the amount of resources and information that has helped me take advantage of all the ways to earn money for my children’s savings. In addition to using the Upromise MasterCard to earn cash back, you can also hook up your credit and debit cards to your account, as well as loyalty cards!

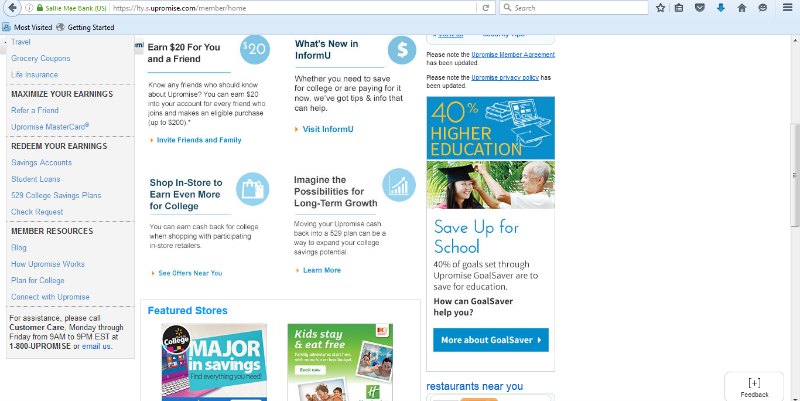

I have included a screenshot of my Upromise dashboard so you can get just a glimpse of the vast amount of resources that both informs and educates you on how to optimize your savings. It may seem like your child has many years until college, but it is never too early to start saving! We all want to ensure that our child is prepared and ready to leave home and this is just one simple way to make that process easier for them (and you!)

I have included a screenshot of my Upromise dashboard so you can get just a glimpse of the vast amount of resources that both informs and educates you on how to optimize your savings. It may seem like your child has many years until college, but it is never too early to start saving! We all want to ensure that our child is prepared and ready to leave home and this is just one simple way to make that process easier for them (and you!)

One thought on “How To Get A Jump-start On Savings”