How to Better Manage Your Money & Track Your Spending on the Go

This is a sponsored post written by me on behalf of EveryDollar and Acorn Influence. All opinions and thoughts expressed are 100% my very my own. #BudgetEveryDollar

This is a sponsored post written by me on behalf of EveryDollar and Acorn Influence. All opinions and thoughts expressed are 100% my very my own. #BudgetEveryDollar

Tax season is always an easy process for us as my husband went to school for accounting and is very familiar with how to do them. Something different that he did for me this year was take all of my bank transactions from the year of 2016 and organize them on a spreadsheet so we could total my expenses for the year. There is nothing more eye opening than discovering just how much you spent at the coffee store in one year… that simple $1.98 cup of coffee a few days a week added up to a number that I am ashamed to admit! Being faced with how much I spent on groceries, going out to eat, clothing and so on was exactly what I needed to make sure that I better manage my money in the new year. With the convenience of technology at our fingertips, learning how to better manage my money and track my spending while on the go has never been easier and I am thrilled to share with you how I am getting smarter about spending money in the new year.

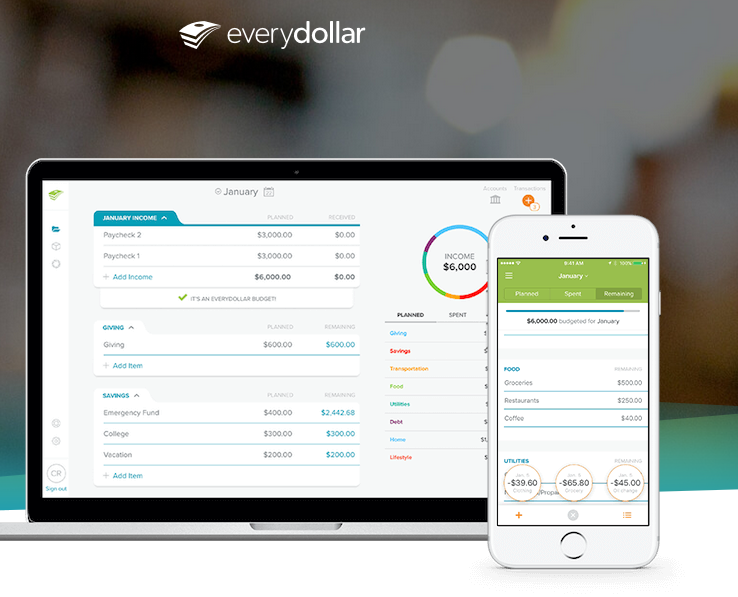

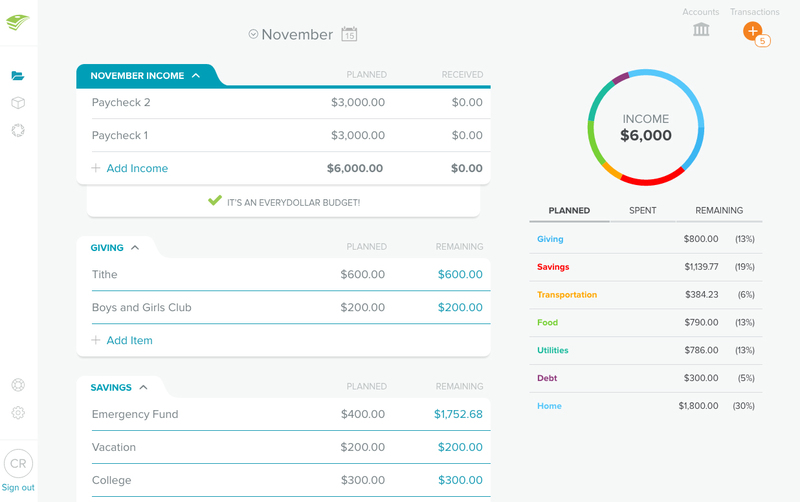

I believe that the most crucial way to gain better control of spending is to ensure that you have a budget all planned out for yourself each month. First you need to determine how much money you have to spend freely after calculating your monthly income and bills/expenses. The EveryDollar app is the best solution I have found to keep help me figure out these numbers and stick to my monthly budget.

With the EveryDollar app I can punch in all of my monthly income, my bills such as; housing, groceries, utility bills, lifestyle expenses as well as my savings and debt amounts. This was a great way for me to see how much I am spending on specific things each month and determine if I need to spend less the following month. By having all of this information provided in one convenient place, I can also create a monthly budget and having this on my phone as a reminder helps me to stick to it. This is also the best solution to eliminating your debt because you will begin to see where you can save and then use that money towards your debt.

I am so proud of myself and delighted to inform you that I was able to pay off all of my debt last year… debt that had been dragging me down for far too many years. As soon as I came to the realization that I would never be free until the debt was paid, my priorities changed significantly. Once I realized that making very large payments for several months and sacrificing in other areas was the solution… I began putting every spare dollar towards my debt. I could not believe how fast I was able to pay it off once the mind set was to stop at nothing to put an end to my debt. I so wish I had known about the EveryDollar app back then, it would have been so much easier to organize the numbers and pay of the debt even faster.

If you are desperate to get a handle on your spending and eliminate that debt, then I highly recommend you utilize the EveryDollar app! I have yet to discover any other app that has such a user friendly interface and a simple approach to budgeting and paying off debt as EveryDollar.