How I File My Taxes as a Self Employed Business

Thank you TaxSlayer for sponsoring this post. Get simple pricing with no surprises when you e-file with TaxSlayer this tax season!

Five years ago I made the decision to start my own business from home and it was one of the best decisions I ever made. While it took an incredible amount of time, dedication and sacrifice, all of that hard work was worth it when I am remind of how fortunate I am to be able to be home for my kids while working. The one thing I do miss about working for an employer is how much simpler it was dealing with my taxes. How much more convenient it was to just receive W9 form at the end of the year and all of the numbers set out in front of me. I have learned a lot over the years and am thrilled to share with you today how I file my taxes as a self-employed business. I have found that https://www.taxfyle.com/income-tax-return-calculator is a great resource during the tax season.

Keep Track of EVERYTHING

My biggest advice to you is to make sure that you are consistent with keeping track of income and expenses throughout the entire year! The more work you do during the year, the less stress and hassle you will encounter when it comes time to file your taxes. Get organized right away and find a place that all of your work related stuff can be kept filed away. I have a filing cabinet right next to my desk where I keep everything labeled and organized, which keeps me sane throughout the year and during tax season. Don’t get sloppy, never have that pile on your desk that you keep neglecting to organize. That is how papers get lost and forgotten. I can’t begin to tell you how many times I would forget to file a receipt, come across it months later and have completely forgotten what it was associated with. So make sure to get your stuff filed right away while the information is fresh!

Get a Tax ID # Number

Another important step to take prior to tax season is to make sure you get a tax ID number for your business. You can get a tax ID number for free and it is a very simple process. It is important for you to get a tax ID number for your business because you will need to give it to your customers that require a W-9 form.

A Home Office

You will also want to create an area in your home that is dedicated to your business, that way you can claim a home office tax deduction. Don’t forget about the utilities, internet bill, cell phone bill and such!

Save Your Receipts

Save all of your receipts! I know I keep mentioning this but it is so important that you keep track of your expenses. Office supplies, a lunch meeting, a new outfit for an important event… anything that in attributed to your business can be categorized as a business expense. Meals and entertainment expenses are all things that you can deduct when filing your taxes, so don’t forget to keep track of those. Also make sure to check out this information on commonly missed deductions, you would be surprised by some and how many you may not have considered.

Earned Income Credit

If your business is fairly new and you earned a modest income this year, you may be eligible for an Earned Income Tax Credit. If you have earned income below a certain threshold, then you qualify for the earned income credit, or EIC. The maximum amount of credit for married couples with three or more qualifying children is $6,269 for 2016, an increase from a total of $6,242 for tax year 2015.

Avoid Tex Penalties

Make sure that you familiarize yourself with taxes and everything you need to know while being self employed, there is plenty of resources out there to help you stay organized and avoid a Tax Penalty.

Now that you have managed to stay organize the entire year with your business, it is time to file those taxes! Fret not my fellow self employed friends… this doesn’t have to be something you dread! There is a simple and affordable way to file your taxes with a company that offers one on one help over the phone.

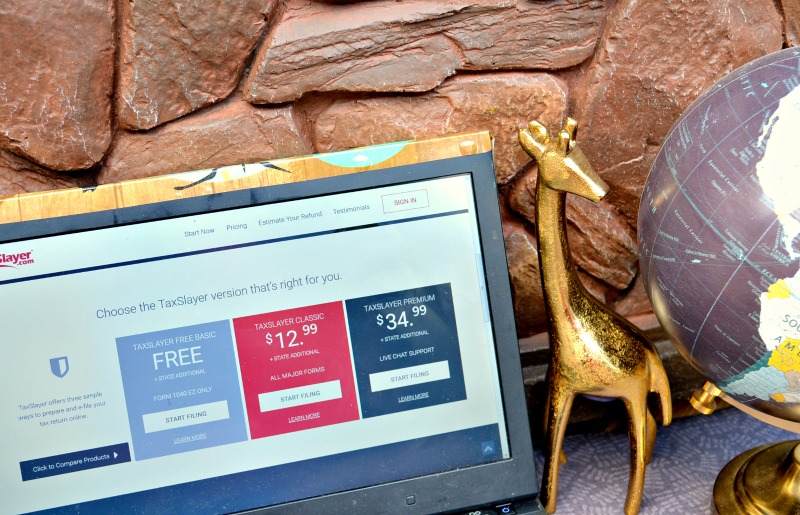

With TaxSlayer.com you can actually choose your level of service and everything else is included. TaxSlayer offers you free live phone and e-mail support if you find yourself stuck and needing assistance. I am also proud to report that TaxSlayer has over 50 years of tax preparation experience, which is a clear indication that customers are loving their service! I find that their simple and transparent approach makes them favorable, but their affordable packages are what really drew me in!

I hope this article was helpful and you were able to gather all of the resources to both prepare and guide you through tax season. Make sure to file your taxes with TaxSlayer.com this year, a trusted company that provides affordable options!

I was selected for this opportunity as a member of CLEVER and the content and opinions expressed here are all my own.