The Importance of Learning About Money at a Young Age

This post is sponsored by Kids Wealth via SwayyEm. All of the thoughts and opinions expressed in this post are 100% my very own. #kidslearnmone

A few weekend ago my two older children (4 & 8) decided they wanted to set up a lemonade stand out in front of the house. I quickly had flashbacks of my childhood and all of the fun I had running lemonade stands in front of my home. So we made a fast trip to the store to get all of the supplies we needed and had the stand ready in no time. We ended up having an amazing turnout and tons of neighbors stopped just to give the children money. So many of them informing the kids of how great it was to see them working for their money. In the end the made $20 that day and filled a jar full of change. My husband (being the accountant he is) told the kids “well now you must deduct the cost of what your mother paid for the cups and lemonade mix. I laughed at him and the kids rolled their eyes, but it didn’t take long for me to realize that this was the perfect learning opportunity! Teaching my kids the importance of learning about money at a young age is undoubtedly a skill that they need to acquire. My kids were ready to take that money they earned and spend it all on some frivolous items at the toy store. What was I teaching them by just allowing them to wipe out their funds immediately after earning it? Thankfully I had Kid Wealth to give me all the tools I needed to start teaching my children about money.

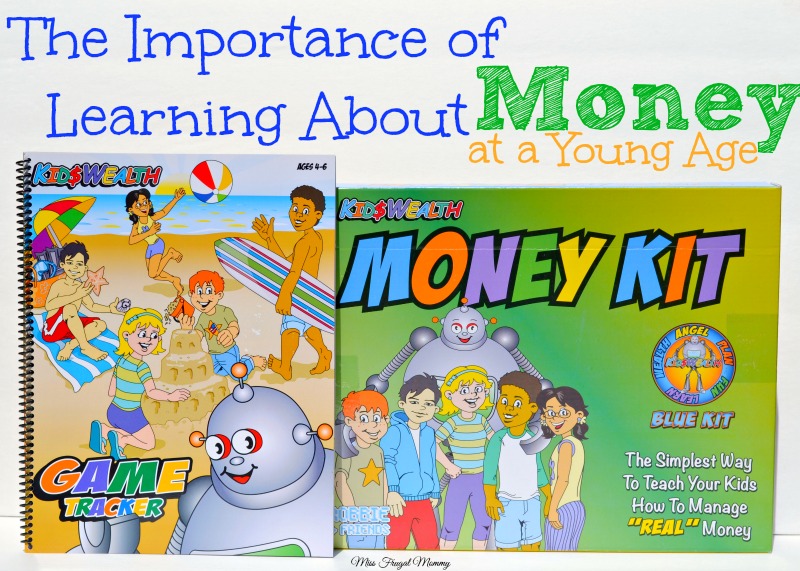

What’s Included?

Kids Wealth is a fun and engaging way to teach kids the importance of money, budgeting, saving and growing wealth through fun and interactive activities. Kids Wealth is the fun and easy system designed to teach kids the value of money and includes a Calendar, Kids Guide, Money Kit, Stickers, Kids Agreement, Age Tracker Booklet and Money Tracker. You can see all of the items that are included in the picture down below.

Teaching my children good spending habits now is setting them up for a better future. They are going to take those skills, apply them when they are adults, and hopefully prevent making any poor financial decisions. There are so many financial lessons that I have learned as an adult that could have easily been prevented had those practises been instilled in me at a young age. Do I blame my parents for this? Not at all! They didn’t necessarily have the tools or resources to help teach me to make good financial decisions. I am fortunate enough to have been introduced to Kids Wealth! The KidsWealth Money Program allocates your child’s Kid’s Pay into five key accounts: Wealth, Plan, Learn, Fun and Angel. You will be able to help your child create a long-term investment account, which teaches your child how to set a goal and how to achieve it. This program also reinforces that learning is a lifelong process worth investing in. Your child has monthly “fun” money to spend on things they want. The program also teaches your child the importance of helping others by doing such things as donating. That was one part of the program that really hit home with my daughter and she knew instantly that that was what she wanted to do with her money. We have a animal refuge league in the area that she has been wanting to volunteer at and my daughter decided to use some of her earnings from the lemonade stand to donate to them! We actually posted about it on Instagram and I have included the picture down below!

Honestly, it is never too early to introduce and start teaching your children about money, you are only setting them up for a more stable future full of healthy financial decisions! Kids Wealth is such a fantastic way to give the children the visualization and real life scenarios so that they may better understand and comprehend the importance of money, budgeting, saving and growing wealth!

Check Out The Kids Wealth Video!