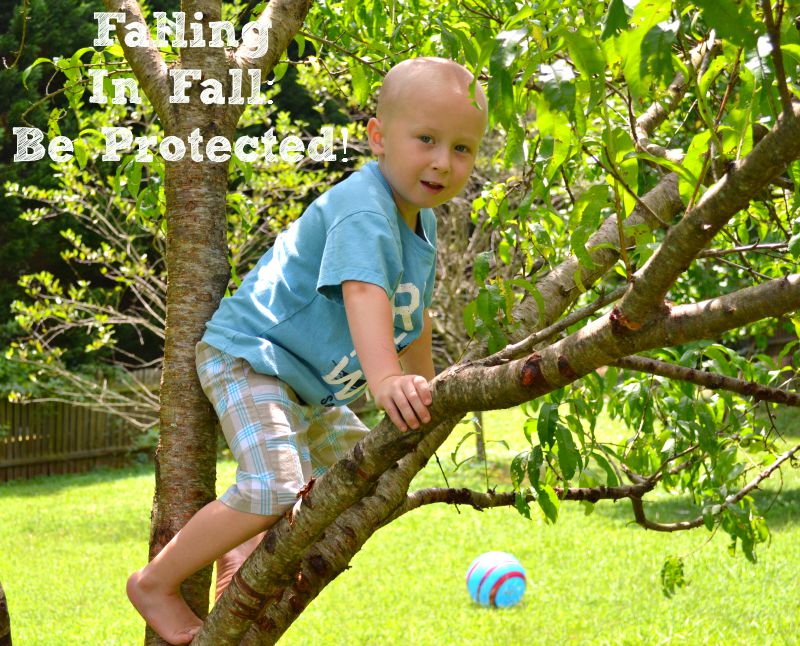

Falling In Fall: Be Protected!

It’s open enrollment season which means it’s time to start thinking about your family’s health care plan. I am the proud mother of three healthy, happy, energetic, brave and adventurous children. We are no strangers to injury and I always have my bag fully stocked with first aid essentials. Unfortunately there are some boo boos this momma can’t heal with her kisses or bandaids and I am confident there will be many more in this parenting journey. That is why I must ensure that I am prepared for falls… that my children are covered in case an injury lands us in an emergency room, again. With open enrollment season I encourage you to take a better look at your options and spend some time researching so that you can be 100% sure you are getting the best plan for your family.

For many employees, now is the time when you can review your employer-sponsored benefits offerings and choose the health insurance policies that best meet your financial and health care needs. Selecting the right health care benefits is undoubtedly one of the most important decisions Americans will make all year, yet an Aflac survey has found that many of us do very little research in order to learn which plans and products really work best for them. In fact… 34% of employees spent 15 minutes or less researching their benefit options in 2014… wow! By not setting aside that vital time to do the research, your are very likely signing yourself up for inadequate health care protection that does not suit you and your families needs.

For many employees, now is the time when you can review your employer-sponsored benefits offerings and choose the health insurance policies that best meet your financial and health care needs. Selecting the right health care benefits is undoubtedly one of the most important decisions Americans will make all year, yet an Aflac survey has found that many of us do very little research in order to learn which plans and products really work best for them. In fact… 34% of employees spent 15 minutes or less researching their benefit options in 2014… wow! By not setting aside that vital time to do the research, your are very likely signing yourself up for inadequate health care protection that does not suit you and your families needs.

Assuming that one health care plan suits all is unrealistic, each person and/or family has different needs when it comes to their health. Today’s workforce is comprised of a number of different generations, including baby boomers, Generation X, millennials/Generation Y and the incoming generation of workers known as Generation Z. Many families are also spanning more generations than in the past, which means one-size-fits-all benefits options just aren’t enough anymore. The type of benefits options a young, single employee needs are significantly different than those for an employee who is supporting multiple dependents or facing more health issues due to advanced age. That’s where voluntary insurance helps, since it allows employees to select voluntary policies that best suit their own needs, as well as the needs of any dependents they may have.

So why should you consider voluntary insurance policies offered by your employer? When there is an unforeseen medical event, many people are often faced with paying copayments, deductibles or treatment costs that are not covered by major medical insurance. There are so many people that would not be able to adjust to the large financial costs associated with a serious injury or illness… out-of-pocket medical expenses could cripple many families. Voluntary policies are actually specifically designed to help you pay for those out-of-pocket expenses, plus they provide cash benefits to be used towards rent, gas, groceries, child care and more.

Parents of accident prone children listen up because this information is for you! The National Safety Council indicates that the average medical expense for an accidental injury is $5,500… could you afford to cough up that amount of cash without the worry of deciding which bills you won’t pay on time? According to the Centers for Disease Control, there are more than 80 million injury-related visits to doctors’ offices, hospital outpatient departments and emergency-treatment facilities in the U.S. each year. Accident insurance helps provide your family with everyday financial protection in the event of an accident. Those benefits pay for things like x-rays, physical therapy, appliances, emergency treatment and more. Now is the time, I can not stress this enough… don’t make this decision lightly, we always think it will never happen to me… but the truth is, it’s always better to be prepared. Make sure you and your family get enrolled in the best insurance this fall!

I was selected for this opportunity as a member of Clever Girls and the content and opinions expressed here are all my own.