What is a Families Biggest Investment?

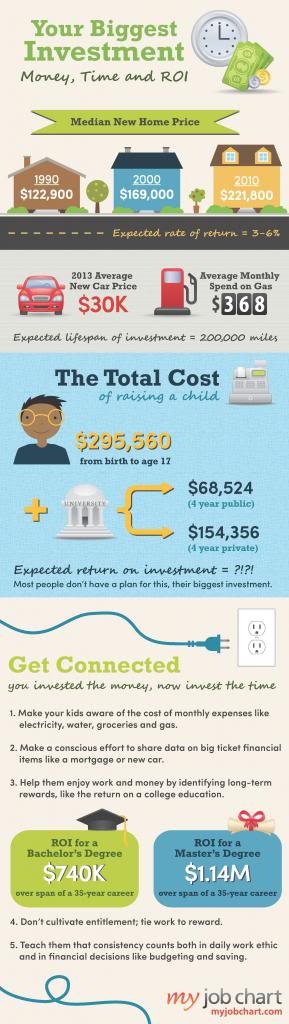

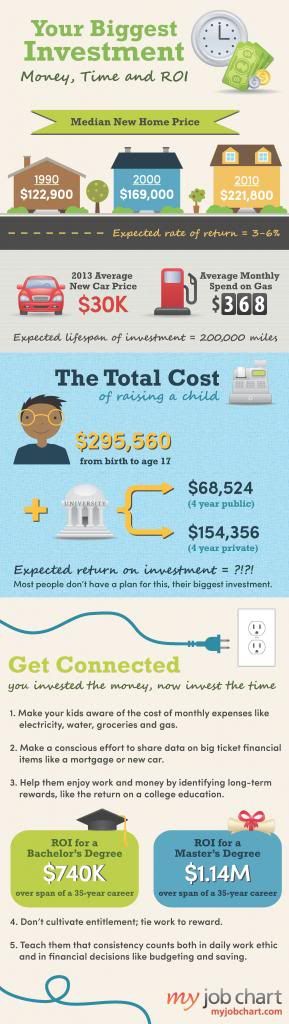

I pondered for a moment when I was first asked this question, eventually coming to the conclusion that buying a home would, hands down, be my family’s biggest investment. I mean, what else could possibly compete with the cost of purchasing a home? Well once I discovered what was more of an investment than purchasing a house or a car, I chuckled at myself. The answer was so blatantly obvious, but I quickly overlooked it. MY KIDS! After reading the article “Your Biggest Investment” it became so clear to me why I was so quick to overlook the obvious. When purchasing a car or home, it is all in the moment. You spend a sufficient amount of time researching and comparing prices, you see the numbers right in front of you and know right then and there how much you are going to pay. The article goes on to explain that we don’t see our children as being our biggest investment because we go years spending a little here and there. Small things such as a hair cut, new shoes, money for the movies, that slowly but surely adds up over time. Realistically, all that money you spent here and there on your child, will average out to $295,000 once they hit 17 years of age. Of course there are tax credits involved with having children (which you can figure out by using an online tax estimator), but it comes nowhere near the average cost. That is a lot of dough and really had me thinking about my future and what actions I should take if we plan to have child number three some day.

As parents, what do you think we should do to make the most out of our biggest investment? The answer is clear, teach your children about money! What better way to prepare your little ones for the world than to show them responsibility alongside money. My six year old daughter recently became curious about the cost of things and gained a new habit of pointing at something and demanding to know the cost. I was happy for her new found interest because her reactions were proof that she was understanding that the cost of living is not cheap. I brought her to a store recently to spend the money she had received from the tooth fairy, we spent a good amount of time in the isles as she hunted for a toy in her price range. It was definitely a great money lesson moment as she began to associate the nicer toys with bigger prices, therefore teaching her that she would have to work a bit harder if she would like to have a nicer toy. We continued on our shopping trip and shopped for groceries, where I would let my daughter know what the cost of everything was. Helping your children to understand the cost of things is an excellent way to give them a better understanding of money.

The article also gives a few other very great tips on teaching out children about money. Including them in financial discussions at home was a favorite of mine. It is a good way for your children to see how money decisions are made and resolved in a home. Helping your children to enjoy earning money was another great idea. If they are enjoying helping around the house and earning money, they will live to higher standards. There is nothing wrong with having a chore chart and paying your children to contribute around the house, it offers great benefits and teaches them good work ethic earlier on in life. Stay in routine and guide them through repetition, they will eventually get a better understanding of earning money, spending, and saving it. This article gives parents a simple guide to help build confidence in our children so that they may grow into responsible young adults whom will be well worth the investment!