We all deserve a lovely bathroom where we can relax and rejuvenate, and wash away the dirt and stress of the day. But a limited budget can stop you from thinking that a stylish space is a possibility. The good news is that you can transform your bathroom into a

It’s one of those things that business owners should always be trying to do: keeping your costs down is, after all, always going to be a good idea, and is the kind of thing that will generally keep you in good stead. If you are thinking about what you might

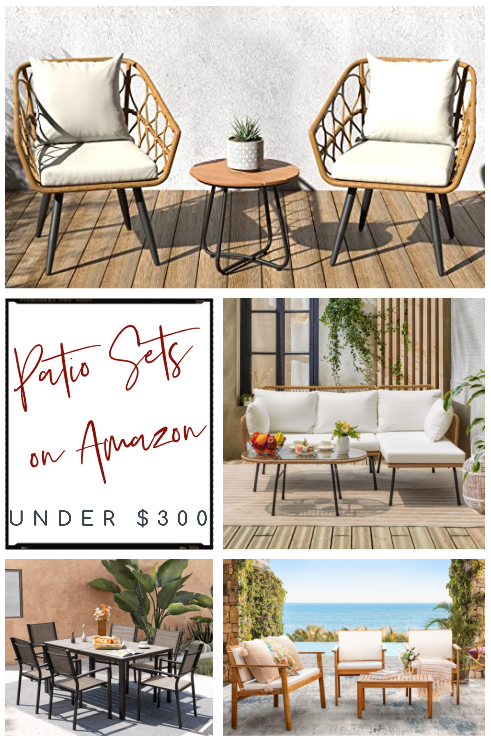

With summer just around the corner, just like you, I find myself looking for deals on new patio sets at my favorite place… Amazon! I have discovered some really affordable options on some patio sets, my goal was to stay under $300 per set. I was pleasantly surprised to find

You never know what’s waiting just around the corner. And having insurance protects you from the worst possibilities. But with so many policies available, things can quickly get expensive. How are you supposed to know which are worth spending your money on and which aren’t? That’s where we come in;

Do you want financial security? While our dreams may include having enough money to live comfortably without worry, achieving that reality may prove more complex than anticipated. By following these strategies and tips for creating financial stability and wealth creation – such as investing, setting good spending/saving habits or managing

Recent statistics show that 79% of college students delay graduation due to financial difficulties. Although this may sound grim, financial challenges are a major issue college students face. This encourages students to look for means of making some extra money. A great way to do this is through passive income

Improving your home can cost a fair chunk of money, but it doesn’t have to. A common misconception is that if you want to improve something it’s going to cost you an arm and a leg to achieve the results that you are looking for. This is simply untrue, and

When you have family members living in other parts of the world, it can be difficult to maintain strong connections. However, with a bit of effort and creativity, it is definitely possible! Here are some tips for keeping in touch with your loved ones who are living abroad. Make Use

Food waste is a significant problem that is affecting many households across the world. In fact, according to recent studies, around one-third of all food produced globally is lost or thrown away. This means that large amounts of the resources, water, and energy used to produce food are wasted as

The winter months are generally more expensive due to excessive heating bills and warmer clothes expenses. This isn’t ideal if you are on a budget. Yet, it is important to stay warm in the winter. Being cold is not comfortable and can cause various health issues. Therefore, it is best to

As technology continues to advance, smart home solutions are revolutionizing the way we interact with our homes, and plumbing maintenance is no exception. By incorporating innovative technologies, homeowners can proactively prevent plumbing issues and save money in the long run. In this blog post, we will explore some of the

Contrary to popular belief, wearing great clothes doesn’t require you to spend a lot of money, especially if you are a big family. You can wear fashionable pieces, develop your own style, and still stick to your shopping budget if you follow these shopping tips. If you are a family